A bank reconciliation is a comparison made between the accounting records held by a company regarding its bank accounts and the modifications made to those accounts by the bank itself. It is a necessary process for companies to undertake, but one that can be excessively long and tedious. Here, we offer you some tips and tricks to help you save time on this process, and make it more efficient.

1. Information and documentation

Firstly, it is essential to have all the necessary information and documentation to hand. As with a jigsaw, if you want to spot which pieces are missing, incorrect, or in the wrong place, you need the greatest possible number of pieces available - that way, you can get a better overall view. Also, if part of the information has not been recorded before you start the process, you will have to make several attempts to complete it, which adds to the time required.

Therefore, if necessary, you must claim the documentation from the appropriate people. For example, there may be some missing receipts for salespeople’s travel expenses, and these will need to be found and recorded.

2. Don't forget the till

Tills are also part of the company's finances, so if they are not taken into account, the bank reconciliation will be much more difficult. It is a good idea to carry out a regular triple reconciliation using the actual cash, a book balance, and the accounting balance. That way, you can reduce the chance of mistakes occurring.

3. Reconcile in sections

It is a good idea to begin the bank reconciliation by checking the closing balance from the previous month, and if necessary, from even further back. This is useful in case a transaction has been accounted for at a date prior to when the previous tally was reached. This way, if an error is found, there will be no need to review everything, item by item; instead, we can check in sections to find out in which month the discrepancy occurs.

4. Analyse discrepancies

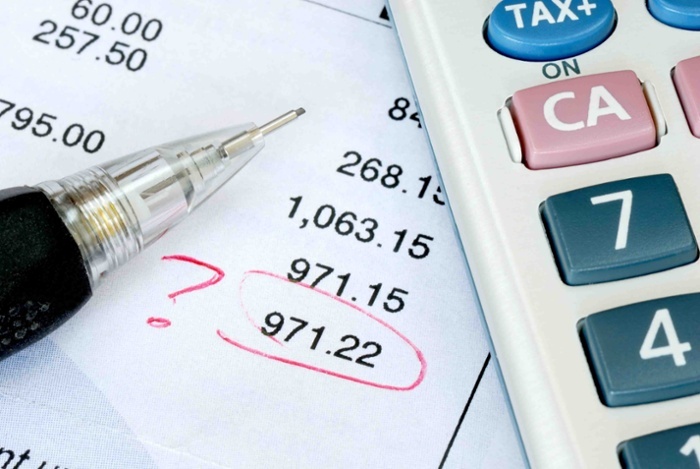

Very often, a problem with the bank reconciliation is the result of "typical" errors, such as:

-

Making an entry twice, which produces a discrepancy equal to the amount of the entry in question

-

Not accounting for a transaction, which will also produce a discrepancy equal to the amount of the overlooked entry

-

Making a mistake when entering a comma, which produces a discrepancy where the digits add up to 9. For example, if instead of entering $12.40, we put in $124.0, the discrepancy will be $111.60. When you add up the digits: 1 + 1 + 1 + 6 = 9

-

Entering a figure with the digits in the wrong order. This also leads to a discrepancy in which the digits add up to 9. For example, if instead of $974, we put $947, the difference is $27, and if we add these figures: 2 + 7 = 9

Before you waste time going through the accounts item by item, you can try to identify the source of the discrepancy by bearing in mind this kind of error, paying close attention to the amount in question, and checking whether there it can be linked to an amount in another transaction. This will save a lot of time and a lot of headaches.

5. Banks also make mistakes

While not common, it is at least possible that the bank may have made a mistake. They may debit an incorrect amount from our account, or a deposit a payment that does not correspond; if we have several different accounts with the same bank, it is possible that they could confuse these accounts when making a deduction or a deposit, and so on. For this reason, if you identify an error for which no explanation can be found, or about which you are in doubt, consult your bank.

6. Reconciling items, the last resort

Putting the discrepancy down as a reconciling item and forgetting about it seems a very easy and tempting solution. But the discrepancy will still be there, so this is not a genuine solution. If they accumulate in excess, the bank reconciliation will become meaningless, with the accounts failing to reflect reality, and the resulting muddle will become harder and harder to resolve.

We must ask for account balances that we have not received, invoices and receipts that have not arrived so that we can be sure, as mentioned in the first section, that we have all the information and documentation we need, and that the books are up to date.

7. Automate the process

As you will already know, any paper-based administration will always take longer and be more prone to error than the same task carried out automatically. The same applies to the process of bank reconciliation. Tools exist to automate this process, or part of it, to make it more efficient and more controllable.

One example is Captio, a management platform for business travel expenses that allows you to import information from the bank and to identify payments relating to journeys carried out by individual employees using company bankcards. Payments are automatically reconciled with the expenses charged by the user - it is easy, simple, and automated.